A Guarantor, when it comes to mortgages, is exactly what it sounds like—they “Guarantee” the mortgage for another person if they are unable to pay back the loan.

A Guarantor, when it comes to mortgages, is exactly what it sounds like—they “Guarantee” the mortgage for another person if they are unable to pay back the loan.

Guarantor’s or co-signers are often used if someone has:

• Damaged or poor credit

• Insufficient income

In most cases, someone with poor credit and/or insufficient income has a more challenging time securing a mortgage. Adding a guarantor can help get the file approved as the lender is assured that he or she will be paid, should the mortgage holder default.

Many people will assume that a co-signer and a guarantor are the same thing. This is not the case though…there are key differences that you should know before becoming a guarantor on a mortgage.

1. Whose name is on the loan?

This may seem like a small detail, but when it comes to loans, whose name is on it matters!

With a guarantor, their name will not be on the title of the property, but it will be on the mortgage. With a co-signor, this changes in that their name will be on the mortgage and on the title of the property. In addition to this, for a guarantor mortgage the guarantor must be a spouse. With a co-signer this is not the case, and you can utilize whomever agrees and meets the qualifications.

2. What’s the Risk?

For the people seeking a guarantor, a portion of risk is alleviated because they have the guarantee of the guarantor. However, for the guarantor, there is a heightened risk. They are responsible for the entire amount of the loan if the borrower defaults at any time. With this in mind, lenders require the guarantor(s), in addition to the borrower(s), to qualify for the loan they are looking to borrow. They must meet the following lending requirements which include:

. Credit Check

. Disclosure of income

. Disclosure of Liabilities

. Disclosure of Assets

It is also highly advisable that a potential guarantor seek legal advice before signing for the loan—and this should be a separate attorney from the one that is involved in the mortgage transaction. Seeking out proper legal advice can allow the potential guarantor to ensure they fully understand the contract, the loan, and any other details.

One final note that should be evaluated by any potential guarantors, is the relationship with the person you will be signing for. You are taking a risk and taking on a lot of responsibility for this person and it is advisable that you know the person well and trust them.

3. What other Variables are there to Consider for Guarantors?

There are a few other things that a guarantor will want to consider before finalizing anything. One of these is the fact that if you are a guarantor, you may not be able to qualify for a large loan or mortgage on your own. Look at your goals and future (or current) expenses before taking on this additional responsibility. As a final note to guarantors, they may want to consider creditor insurance (amount varies based on the loan) to protect themselves and their assets.

4. Can your relationship with your bank dictate if I need a Guarantor?

In some cases, yes! If you have a long-standing relationship with your current bank and they have seen your ability to responsibly handle debt-repayment, they may consider not requiring you to have a guarantor. This is not always the case, but it is an option that your mortgage broker may review with you.

These 4 facts along with your mortgage broker’s advice, can help you decide if you want to be a guarantor, or if you truly require a guarantor mortgage after all! If you have any other questions about guarantors or co-signers, we encourage you to reach out to your Dominion Lending Centres Mortgage Broker—we know they will be happy to help!

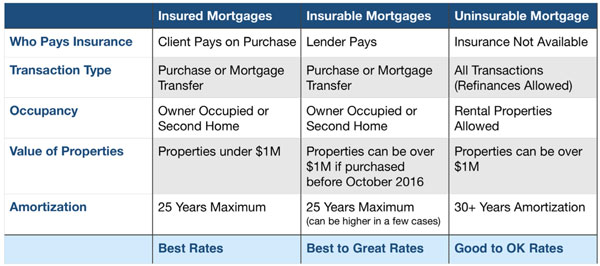

Since we know that lenders can back-end insure our mortgages (please read our Mortgage Insurance Market and Wholesale Lenders article first), and that this specifically makes these mortgage investments more attractive to investors, what does it mean for borrowers (every day people like you and me)?

Since we know that lenders can back-end insure our mortgages (please read our Mortgage Insurance Market and Wholesale Lenders article first), and that this specifically makes these mortgage investments more attractive to investors, what does it mean for borrowers (every day people like you and me)?

A Guarantor, when it comes to mortgages, is exactly what it sounds like—they “Guarantee” the mortgage for another person if they are unable to pay back the loan.

A Guarantor, when it comes to mortgages, is exactly what it sounds like—they “Guarantee” the mortgage for another person if they are unable to pay back the loan.