There seems to be some confusion about what it actually means to co-sign on a mortgage… and any time there is there is confusion about mortgages, it’s time to chat with your trusted Dominion Lending Centres mortgage professional!

There seems to be some confusion about what it actually means to co-sign on a mortgage… and any time there is there is confusion about mortgages, it’s time to chat with your trusted Dominion Lending Centres mortgage professional!

Let’s take a look at why you would want to have someone co-sign your mortgage and what you need to know before, during and after the co-signing process.

Qualifying for a mortgage is getting tougher, especially with the 2017 government regulations. If you have poor credit or don’t earn enough money to meet the banks requirements to get a mortgage, then getting someone to co-sign your mortgage may be your only option.

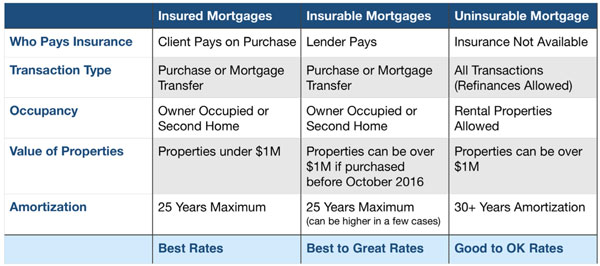

The ‘stress test’ rate is especially “stressful” for borrowers. As of Jan. 1, 2018 all homebuyers with over 20% down payment will need to qualify at the rate negotiated for their mortgage contract PLUS 2% OR 5.34% which ever is higher. If you have less than 20% down payment, you must purchase Mortgage Default Insurance and qualify at 5.34%. The stress test has decreased affordability, and most borrowers now qualify for 20% less home.

In the wise words of Mom’s & Dad’s of Canada… “if you can’t afford to buy a home now, then WAIT until you can!!” BUT… in some housing markets (Toronto & Vancouver), waiting it out could mean missing out, depending on how quickly property values are appreciating in the area.

If you don’t want to wait to buy a home, but don’t meet the guidelines set out by lenders and/or mortgage default insurers, then you’re going to have to start looking for alternatives to conventional mortgages, and co-signing could be the solution you are looking for.

In order to give borrowers, the best mortgage rates, Lenders want the best borrowers!! They want someone who will pay their mortgage on time as promised with no hassles.

If you can’t qualify for a mortgage with your current provable income (supported by 2 years of tax returns and a letter of employment) along with solid credit, your lender’s going to ask for a co-signer.

Ways to co-sign a mortgage

The first is for someone to co-sign your mortgage and become a co-borrower, the same as a spouse or anyone else who you are actually buying the home with. It’s basically adding the support of another person’s credit history and income to those initially on the application. The co-signer will be put on the title of the home and lenders will consider them equally responsible for the debt should the mortgage go into default.

Another way that co-signing can happen is by way of a guarantor. If a co-signer decides to become a guarantor, then they’re backing the loan and essentially vouching for the person getting the loan that they’re going to be good for it. The guarantor is going to be responsible for the loan should the borrower go into default.

Most lenders prefer a co-signer going on title, it’s easier for them to take action if there are problems.

More than one person can co-sign a mortgage and anyone can do so, although it’s typically it’s the parent(s) or a close relative of a borrower who steps up and is willing to put their neck, income and credit bureau on the line.

Ultimately, as long as the lender is satisfied that all parties meet the qualification requirements and can lessen the risk of their investment, they’re likely to approve it.

Before signing on the dotted line

Anyone that is willing to co-sign a mortgage must be fully vetted, just like the primary applicant. They will have to provide all the same documentation as the primary applicant. Being a co-signer makes you legally responsible for the mortgage, exactly the same as the primary applicant. Co-signers need to know that being on someone else’s mortgage will impact their borrowing capacity while they are on title for that mortgage. They’re allowing their name and all their information to be used in the process of a mortgage, which is going to affect their ability to borrow anything in the future.

If someone is a guarantor, then things can become even trickier the guarantor isn’t on title to the home. That means that even though they’re on the mortgage, they have no legal right to the home itself. If anything happens to the original borrower, where they die, or something happens, they’re not really on the title of that property but they’ve signed up for the loan. So they don’t have a lot of control which can be a scary thing.

In my opinion, it’s much better for a co-signer to be a co-borrower on the property, where you can actually be on title to the property and enjoy all of the legal rights afforded to you.

The Responsibilities of Being a Co-signer

Co-signing can really help someone out, but it’s also a big responsibility. When you co-sign for someone, you’re putting your name and credit on the line as security for the loan/mortgage.

If the person you co-sign for misses a payment, the lender or other creditor can come to you to get the money. The late payment would also show up on your credit report.

Because co-signing a loan has the potential to affect both your credit and finances, it’s extremely important to make sure you’re comfortable with the person you’re co-signing for. You both need to know what you’re getting into. I recommend looking into Independent Legal Advice between all co-borrowers.

Co-signing is NOT a life sentence Just because you need a co-signer to get a mortgage doesn’t mean that you will always need a co-signer.

In fact, as soon as you feel that you’re strong enough to qualify without your co-signer – you can ask your lender to reconsider your application and remove the co-signer from the title. It is a legal process so there will be a small cost associated with the process, but doing so will remove the co-signer from your loan (once you are able to qualify on your own), and release them from the responsibility of the mortgage.

Removing a co-signer technically counts as changing the mortgage, so you need to check with your mortgage broker and lender to ensure that the lender you choose doesn’t count removing a co-signer as breaking your mortgage, because there could be large penalties associated with doing so.

Co-signing is an option that could help a lot of people buy a home, especially first time home buyers who are typically starting their career and building their credit bureau.

A final mortgage tip: a couple of alternatives to co-signing that could help someone out:

- providing gift funds for a down payment

- paying off someone else’s debt, giving them more funds to pay the mortgage

This post applies if you are taking a new mortgage, whether it’s for a purchase, refinance, or renewal. The variable remains the main contender.

This post applies if you are taking a new mortgage, whether it’s for a purchase, refinance, or renewal. The variable remains the main contender. HomeEquity Bank is the only bank in Canada that currently offers the CHIP Reverse Mortgage as well as a secondary product, Income Advantage. These two products are options for homeowners unlike anything else out there. Instead of borrowing money to purchase a house, they will lend you money if you already have purchased one (as long as you qualify).

HomeEquity Bank is the only bank in Canada that currently offers the CHIP Reverse Mortgage as well as a secondary product, Income Advantage. These two products are options for homeowners unlike anything else out there. Instead of borrowing money to purchase a house, they will lend you money if you already have purchased one (as long as you qualify). I am often asked if it’s hard to compete with the banks. While they may offer competitive rates at times, right now we have much better rates than the banks. However, we have certain advantages which allow us to blow them out of the water most of the time.

I am often asked if it’s hard to compete with the banks. While they may offer competitive rates at times, right now we have much better rates than the banks. However, we have certain advantages which allow us to blow them out of the water most of the time.

Over the last month, as the big banks and many of our monolines mortgage lenders wind down their fiscal year, we are starting to see some very obvious changes in what your credit score can get you.

Over the last month, as the big banks and many of our monolines mortgage lenders wind down their fiscal year, we are starting to see some very obvious changes in what your credit score can get you. Since we know that lenders can back-end insure our mortgages (please read our

Since we know that lenders can back-end insure our mortgages (please read our

A Guarantor, when it comes to mortgages, is exactly what it sounds like—they “Guarantee” the mortgage for another person if they are unable to pay back the loan.

A Guarantor, when it comes to mortgages, is exactly what it sounds like—they “Guarantee” the mortgage for another person if they are unable to pay back the loan.

As many of you already know, Canada just became the second country in the world to legalize marijuana for medical and recreational purposes. Of course, this historic moment in Canadian history has cannabis activists jumping for joy while others are not s-toked on the idea.

As many of you already know, Canada just became the second country in the world to legalize marijuana for medical and recreational purposes. Of course, this historic moment in Canadian history has cannabis activists jumping for joy while others are not s-toked on the idea.